The White House published on Saturday a study that estimated that 8.2 to 9.2 million more Americans could be without medical insurance as a result of a subsequent recession if the «great and beautiful bill» of the budget of President Donald Trump is not approved.

The finding comes from a note from the Blannel Economic Advisors Council entitled «Health Insurance Opportunity Cost If the 2025 Budget Conciliation Law is not approved.»

The investigation assumes that the United States had approximately 27 million people without insurance in 2025. If the budget bill is not approved, that could increase to approximately 36 million people without insurance, much closer to approximately 50 million people who were not safe before the implementation of the affordable care law (ACA), also known as Obamacare, in 2010, in 2010, according to the Remo.

‘Failure is not an option’: Trump’s Budget bill will be a ‘large’ help for the elderly, says the Tax Writer of the Higher House

President Donald Trump during a special envoy ceremony Steve Witkoff at the Oval Office of the White House in Washington, DC, May 6, 2025. (Reuters/Kent Nishimura/File Photo)

The memorandum says that the estimate is «based on the assumption that the states that expanded Medicaid with relatively generous eligibility will be withdrawn to meet the balanced budget requirements and will try to provide more unemployment support during a severe recession.» It also qualifies its conclusions saying that the analysis is «without policy countermeasures», which the White House describes as a «worse very unlikely but plausible» scenario.

The White House projects that the expiration of Trump Tax cuts 2017 in 2026 and other clashes would trigger a «moderate to severe recession.» Economic advisors report that an «important recession» would result in a reduced consumer expense as a result of higher individual taxes, a lower investment in small businesses and hiring, as a result, higher individual taxes, global confidence shock, including concerns about the competitiveness of the United States and the deflation of the dollar, the credit of the deflation of the dollar and what drives the highest real interest rates.

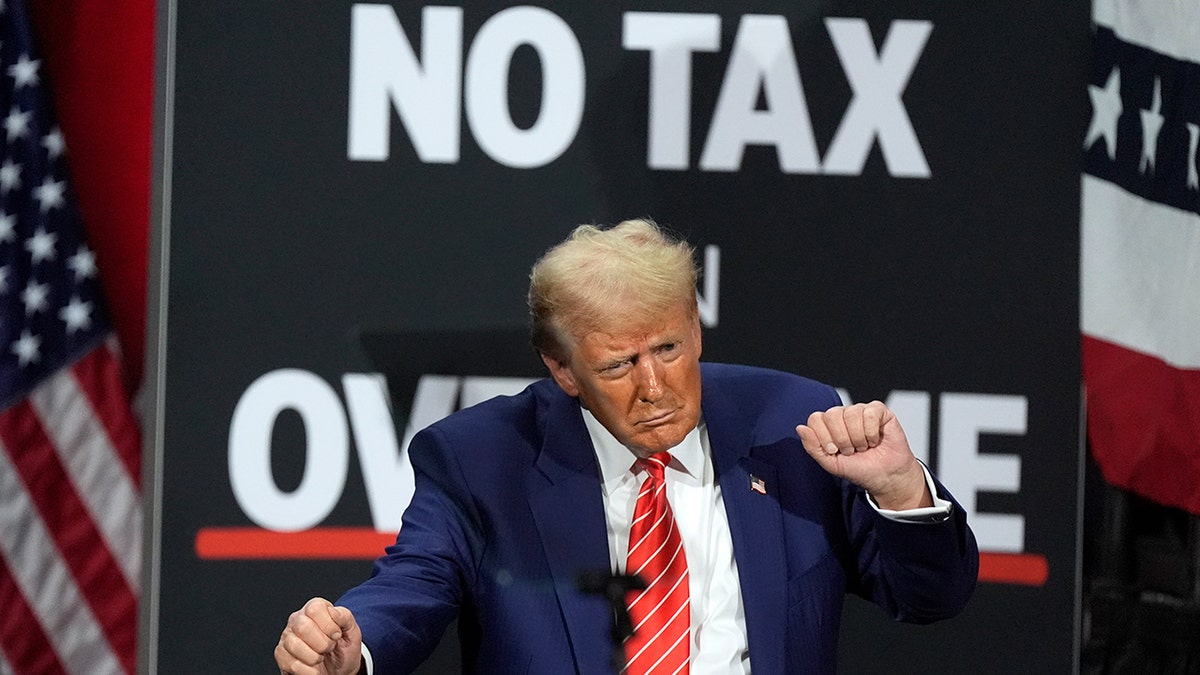

Republican presidential candidate Donald Trump dances in a campaign event at the Cobb Energy performing Arts Center, on October 15, 2024, in Atlanta. (Photo AP/John Bazemore, Archive)

Rebel Mutinio of the Republican Party threatens to derail the ‘great and beautiful bill’ of Trump before the obstacle of the key committee

According to the estimate of the «higher» advisors of the impact of not extending Trump’s tax cuts, the United States GDP could hire approximately 4% for two years, similar to the 2008 recession. Unemployment could increase by four percentage points, resulting in approximately 6.5 million employment losses. Of those 6.5 million employment losses, 60% had an insurance sponsored by the employer, so the White House projects approximately 3.9 million people to lose coverage and as a result does not sure.

The memorandum also anticipates a loss of individual and market coverage, since those who no longer have insurance sponsored by the employer can no longer afford to buy insurance themselves. The White House awaits a drop of 15% of approximately 22 million registered in 2026 to approximately 3.3 million losing coverage.

The president of the House of Representatives, Mike Johnson, R-LA., He speaks during a press conference at Capitol, on May 6, 2025, in Washington. (AP Photo/Rod Lamkey, Jr., Archive)

Without the approval of the «great and beautiful bill», Medicaid and the registration of the Subsidized Plan of ACA could experience registration friction of 10%, resulting in approximately 500,000 to 1 million people who lose or do not gain coverage, according to the Memo. According to the White House, the expiration of Trump’s tax cuts in 2017 would disproportionately affect non -citizens, concert workers and early retirees. The advisors evaluate that people in those working classes without insurance sponsored by the employer could no longer pay the coverage as a result of a recession, which leads to 500,000 to 1 million losses of insurance between «vulnerable segments.»

The president of the House of Representatives, Mike Johnson, Republican of La-La., Works to obtain the «great beautiful act» through the house through a self-imposed deadline of the day of the fallen despite the divisions between the Republicans, who maintain control of the lower camera by a thin margin of shaving.

The invoice of 1,116 pages includes more than $ 5 billion in tax cuts, costs that are partially compensated for expense cuts in other places and other changes in the fiscal code, and would make permanent tax cuts of the Trump’s first mandate.

Click here to get the Fox News application

He also realizes that many of Trump’s campaign promises, including the temporary termination of taxes on extra hours and advice for many workers, creating a new tax exemption of $ 10,000 in loan interest for cars for cars for cars made in the United States and even creating a new «Maga account» tax free that would contribute $ 1,000 to children born in their second mandate.

Associated Press contributed to this report.